There are a lot of bail bondsmen in Baltimore. And you can probably imagine why. The city is full of crime and has a high poverty rate.

But there’s one bail bondsman that stands out in Charm City. If you ask any Baltimorean on the street to name one bondsman in the area, chances are they’ll name this one: Big Boyz Bail Bonds.

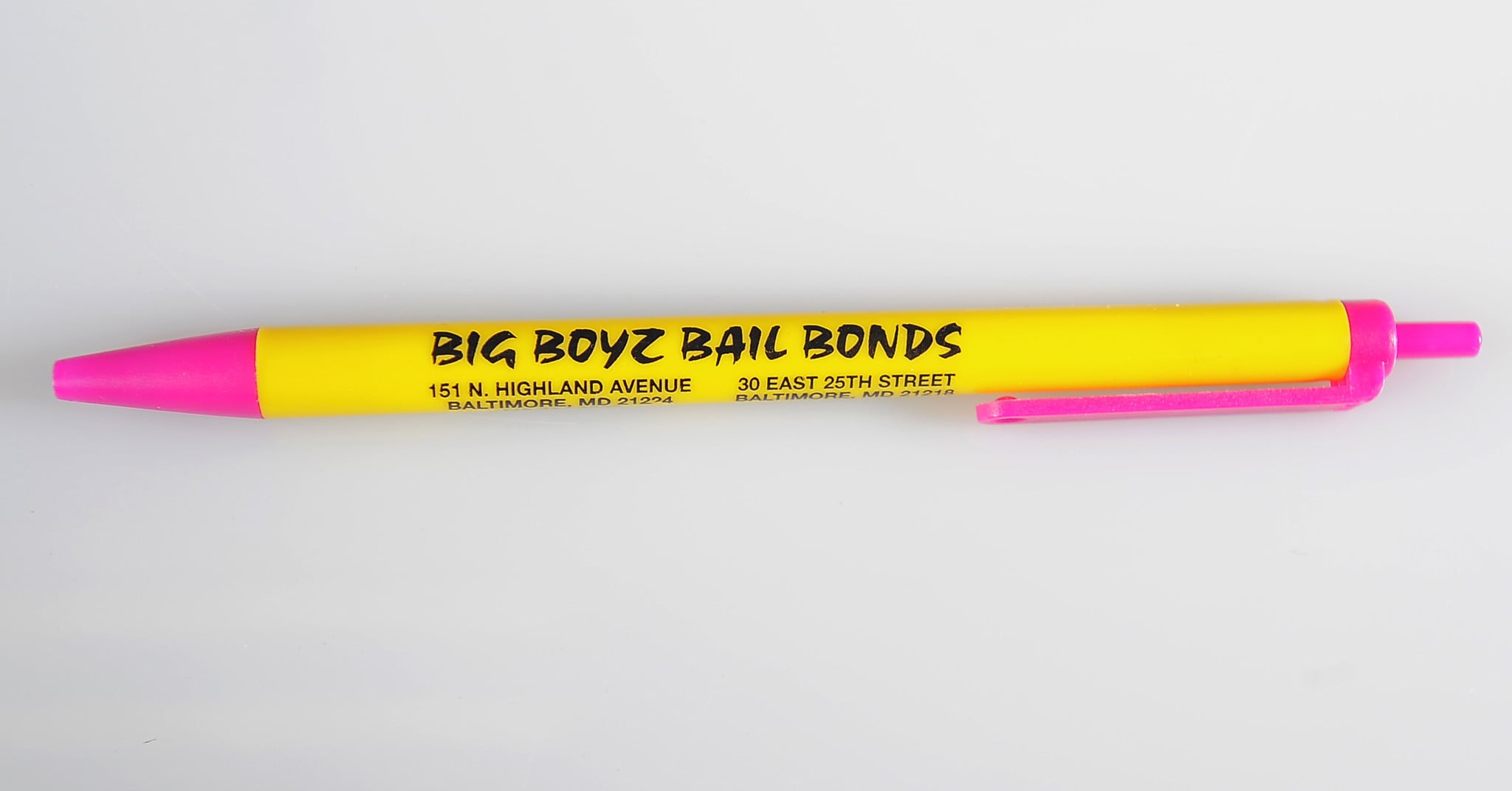

Whether you’ve needed bail bond services or not, every Baltimorean knows the name Big Boyz. And it has everything to do with this pen:

Over the past few decades, Big Boyz has distributed these pens with this exact color scheme all over Baltimore. And now these things are everywhere: bars, restaurants, nightclubs, attractions… no matter where you are in Baltimore City, chances are you’re less than 100 feet away from one of these pens. Every city resident has at least one of these in their junk drawer.

Along with Old Bay, National Bohemian beer, and Berger cookies, the Big Boyz pens are now a staple of the city — and they are probably one of the most successful advertising campaigns to not receive any attention outside of Baltimore.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Pens are cheap. You can order custom pens in bulk for well under $0.10 each. And every bar, restaurant, nightclub, attraction, and other business will take free pens if you’re giving them out. It’s a great example of cheap advertising done well.

Bigger corporations can often miss the mark when it comes to advertising. And when they do, it can be disastrous for their reputation. Right now Nike is going through the public grind with its recent ad featuring Colin Kaepernick.

But whether or not ad campaigns work, there’s one thing for sure: They’re expensive.

Nearly $600 billion is spent globally on advertising each year. In the U.S. alone, over $250 billion is spent annually on advertising. And this is an expense investors should watch.

The world’s largest advertiser is the multinational consumer goods corporation Procter & Gamble (NYSE: PG). It’s estimated that Procter & Gamble spends $10.5 billion per year on advertising. That’s a very significant figure considering P&G’s net earnings last year was $15.3 billion.

Another big spender on advertising is a similar company, Unilever (NYSE: UL). Unilever spends some $8.7 billion annually on advertising. Again, that’s a very significant figure considering the company’s profit of $7.5 billion in 2017.

And this is the norm. Many major multinational corporations end up spending a significant part of their operating budgets on advertising. In my opinion, this is a massive waste of resources.

Advertising is necessary. But too much advertising is expensive and can easily backfire on a company. Bad advertising can be worse.

One company guilty of too much advertising is GEICO. GEICO has several different ad campaigns currently running, and none of them are very good. There’s that talking gecko, the strap of cash with eyes, the hump day camels, and I’m sure I’m forgetting one or two.

Previously, GEICO had the cavemen, the “did you know” campaign, and dozens of others I don’t even remember. Want to see something crazy? Check out the full list of GEICO advertising campaigns on Wikipedia.

Do large corporations just throw advertising campaigns against the wall to see what sticks? It seems like it. And that is a massive waste of resources that should concern investors.

I’m not an advertising expert by any means. But I know good advertising doesn’t have to cost a lot of money. Just consider Big Boyz pens.

How much money are the companies you’re invested in spending on advertising each year? Is it worth it?

Advertising budgets can often be an overlooked expense. But they’re one investors should be aware of.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.